Salary after tax

Income in respect of a decedent IRD is the income received after someone dies but not included in the persons final tax return. Also known as the Old-Age Survivors and Disability Insurance OASDI the Social Security tax must be paid by all employees and self-employed earners.

Pre Tax Income Vs Income After Tax Your Real Pay Budgeting Money Money Management Advice Pinterest For Business

Your average tax rate is 217 and your marginal tax rate is 360.

. Try out the take-home calculator choose the 202223 tax year and see how it affects your take-home pay. After this you will pay 20 on any of your earnings between 12571 and 50270 and 40 on your income between 50271 and 150000. Ad See the Paycheck Tools your competitors are already using - Start Now.

Anything you earn above 150000 is taxed at 45. Find out the benefit of that overtime. Want to learn what lifestyle you can expect with your salary in Dublin.

KiwiSaver knumber optional The percentage you contribute towards KiwiSaver. That means that your net pay will be 43041 per year or 3587 per month. No state income tax.

The income tax rules and regulations of that particular country are factored in when calculating your net salary. For instance it is the form of income required on mortgage applications is used to determine tax brackets and is used when comparing salaries. If your salary is 40000 then after tax and national insurance you will be left with 30879.

120000 Estimated Tax Return 117 Tax withheld credits Excess income tax withheld 17 Tax offsets LITO 100. In summary your employer withholds three types of taxes from your paycheck. Applies only on the first 147000 USD that you earn at a rate of 62.

Your Results Read a full breakdown of the tax you pay. Salary After Tax the money you take home after all taxes and contributions have been deducted. The rates which vary depending on income level and filing status range from 140 to 1075.

Salary Before Tax your total earnings before any taxes have been deducted. Our online tax calculator is in line with changes announced in the 20222023 Budget Speech. After-Tax Income In the US the concept of personal income or salary usually references the before-tax amount called gross pay.

The Garden State has a progressive income tax system. Read reviews on the premier Paycheck Tools in the industry. The default assumes you dont have a loan.

All you need to do is let our calculator know which countrys tax rules apply to you. How much tax will I pay. How to use the Take-Home Calculator To use the tax calculator enter your annual salary or the one you would like in the salary box above If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month.

Simply enter your current monthly salary and allowances to view what your tax saving or liability will be in the tax year. Also known as Gross Income. If you make 55000 a year living in the region of California USA you will be taxed 11676.

Just type in your gross salary select how frequently youre paid and then press Calculate. Tax Year Pay Frequency Annual Pay 4893300 Taxable Income 6000000 Superannuation 630000 Tax 1106700 Income tax 996700 LITO Low Income Tax Offset -10000 Medicare Single no dependants. For ease of use we had to make a few assumptions for this calculator some of which have significant tax implications.

That means that your net pay will be 43324 per year or 3610 per month. This marginal tax rate means that your immediate additional income will be taxed at this rate. For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000.

Scroll down to see more details about your 40000 salary Calculator Options. Your average tax rate is 212 and your marginal tax rate is 396. Also known as Net Income.

This means that after tax you will take home 2573 every month or 594 per week 11880 per day and your hourly rate will be 1923 if youre working 40 hoursweek. Also known as Gross Income. Enter Your Details Select 202223 in Tax Year and the calculator will show you what impact this has on your monthly take home pay and how much tax youll pay over the year.

The tax goes into funds for. The money for these accounts comes out of your wages after income tax has already been applied. No county or city income tax.

Overview of New York Taxes New York state has a progressive income tax system with rates ranging from 4 to 109 depending on taxpayers income level and filing status. Updated for April 2022. Student Loan ly optional Apply this if you have a student loan.

Welcome to the Salary Calculator - UK New. How to calculate annual income. If you make 55000 a year living in the region of New York USA you will be taxed 11959.

Overview of New Jersey Taxes. On a 493000 salary you. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

No matter where in the world youre working from our income after tax calculator will make it easy for you to calculate your net salary. Calculate how tax changes will affect your pocket. The default assumes you have opted out.

Tax Rates 202223 IMPORTANT. The calculator will return your estimated salary after tax and total taxes due. Also known as Net Income.

The reason to use one of these accounts instead of an account taking pre-tax money is that the money in a Roth IRA or Roth 401k grows tax-free and you dont have to pay income taxes when you withdraw it since you already paid taxes on the money. Sage Income Tax Calculator. Retirement benefits benefits for widows and widowers and disability benefits.

Salary After Tax the money you take home after all taxes and contributions have been deducted. Salary Before Tax your total earnings before any taxes have been deducted. When beneficiaries take over a deceased persons finances.

Its so easy to use. This marginal tax rate means that your immediate additional income will be taxed at this rate. It can be any hourly weekly or annual before tax income.

This is known as your personal allowance which works out to 12570 for the 20222023 tax year. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. We already calculated the federal income tax on 493000 dollars.

Total Tax Due the sum of all taxes and contributions that will be deducted from your gross salary. The Salary Calculator has been updated with the latest tax rates which take effect from April 2022.

Gross Vs Net Income Financial Infographic From Accc Learn More About Personal Finances To Better Manage Your Money Net Income Credit Card Debt Relief Income

How Much Money You Take Home From A 100 000 Salary After Taxes Depending On Where You Live Salary Life Money Hacks Smart Money

Salary Ctc Components And What Is Taxable Financial Planning Investing Income Tax

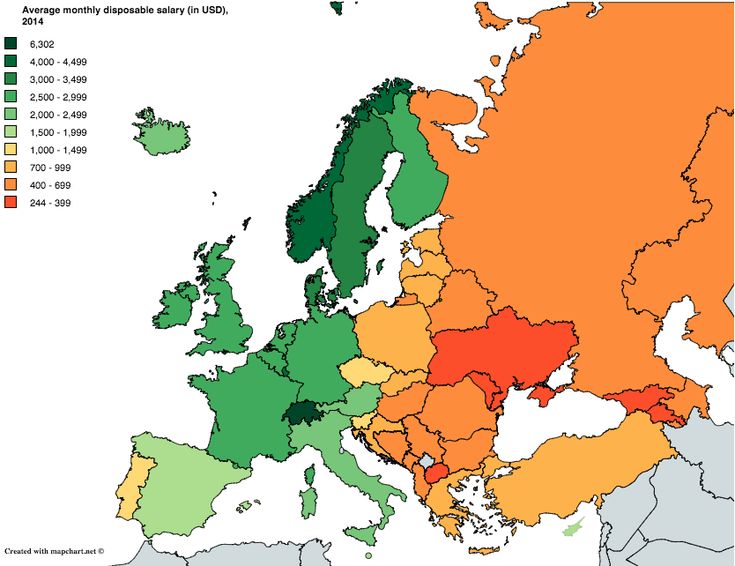

Amazing Maps On Twitter Amazing Maps Europe Map Map

What Is Annual Income How To Calculate Your Salary

Salary Calculator Salary Calculator Calculator Design Salary

Income Tax Calculator Colorado Salary After Taxes Income Tax Payroll Taxes Federal Income Tax

Ctc Salary Structure Income Tax Salary Employment

80 000 Income Tax Calculator New York Salary After Taxes Income Tax Payroll Taxes Salary

After Tax Income On 50000 In Canada For 2014 Income Tax Income Earn More Money

How To Sell Online Payslips To Your Employees Payroll Payroll Template Things To Sell

Income Tax Paid By Republic Of China

Yearly After Tax Income For 100k Yearly Salary In The United States The Federal Income Tax On A 100k Yearly Salar Salary Federal Income Tax Additional Income

Income Tax Just Joined Your First Job Here S How Income Tax Is Calculated On Your Salary Business News Income Tax Tax Saving Investment Income

How To Calculate Income Tax On Salary In Pakistan Learn How To Check Your Income Tax Rates On Your Monthly Salary Online In 2022 Income Tax Income Salary

Work Out Your Salary After Taxes At Maltasalary Com Salary Workout Tax

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator